The Quadrant of Predictions

Why you should spend your investing time making predictable but (in)convientently distant forecasts

Long-term forecasts are often highly accurate and reliable. This can be incredibly valuable to policy makers, entrepreneurs and investors. Despite this, these predictable long-term forecasts are often ignored. Why?

Not all forecasts are created equal. Predicting when the sun will rise, for example, can be done with absolute precision far into the future but a long-term weather forecast is notoriously unreliable. Climate forecasting is useless in helping us to decide if we need to take our umbrellas to work tomorrow, is very reli

able at predicting the long-term trajectory of the climate crisis.

Humans have a bias towards short-term forecasts

As humans, we draw on our past experiences to make conscious and unconscious forecasts every day. Most of those experiences fall within a standard range or ‘normal distribution’. This means I can confidently predict that it won’t be 40⁰C in Glasgow tomorrow and that I won’t meet a 8 foot tall postman.

Most of our conscious predictions are like forecasting the morning commute (normally distributed and short-term). Unfortunately, this creates a problem: it gives humans an intuitive bias towards the short-term. As a result, we tend to view long-term forecasting as hard – perhaps even as pointless. But in fact, as with climate forecasting, some long-term predictions can be surprisingly accurate and incredibly valuable.

Financial markets are unpredictable in the short-term

Financial markets are complex adaptive systems. They are driven by emotions as much as by information. They are not efficient in the short-term (as EMH claims) and their returns are not normally distributed (as CAPM suggests). Despite this, a huge amount of analytical time and money are devoted to trying to forecast ‘the next print’, (be that inflation data or company results). Yet despite the application of computing power and human resources that dwarf those available to the Met Office, short-term interest rate forecasts remain much worse than their weather equivalents.

Long-term change within markets can be predictable

Whilst financial markets are unpredictable in the short term, the initial conditions surrounding us today make certain long-term change extremely likely. For example…

computing power

data storage

solar panels

wind turbines

genome sequencing and

battery energy storage

…will all continue getting cheaper at highly predictable rates over the next five-to-10 years, driven by Wright’s Law learning curves.

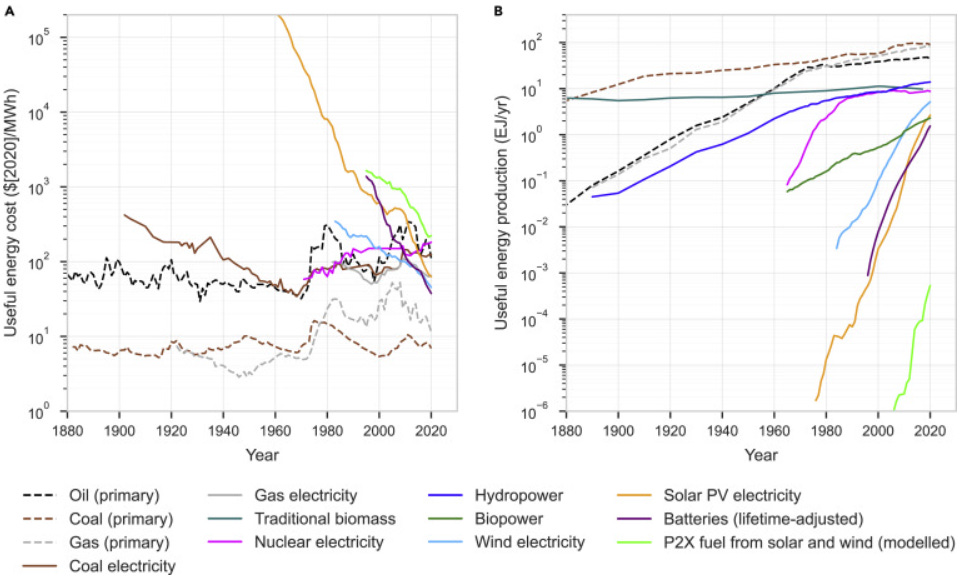

Meanwhile, fossil fuels will remain predictably unpredictable in the short-term and predictably expensive in the long-term (and not just in terms of environmental and social damage). Prices of coal, oil and gas are volatile, but have never declined in cost. A paper published in 2022 by the Institute for New Economic Thinking at the Oxford Martin School showed that, after adjusting for inflation, prices of fossil fuels today are roughly where they were 140 years ago…

The cost of renewable energy is falling rapidly; the cost of fossil fuels is not. In most cases, unsubsidised renewables are already the cheapest option

Source: University of Oxford, Institute for New Economic Thinking, reproduced with permission

This process of predictable long-term change isn’t confined to clean tech. Software, machine learning and artificial intelligence will continue to ‘eat the world’. Many known technologies will converge and create opportunities to innovate and solve significant problems such as climate change, biodiversity loss and education inaccessibility.

This is all useful information to investors. It means we can confidently predict that many incumbent companies and industries will be disrupted. As investors we can focus our attention on the areas of predictable long-term growth and (equally importantly) ignore those in predictable terminal decline.

The costs of solar is falling exponentially

Source: IRENA / Our World in Data

Predictions can be easy, but investing is still hard

Like all investors, we need to find companies that can create value from these long-term trends as they unfold. When we successfully identify such companies, it will take time for compounding to do its work and for the market to appropriately weigh their value. In the meantime, perceived changes in a company’s ability to succeed will lead to volatility, putting pressure on us to buy, sell (or hold). Uncontrollable and unpredictable shifts in short-term sentiment (and economic cycles) will have a meaningful impact on company valuations across the market.

If you stand for nothing, you’ll believe in anything

Despite these challenges, one benefit of investing in highly predictable long-term trends – particularly when you have a positive-impact perspective – is that they provide a ‘true north’ when enduring the inevitable short-term storms that hit.

We do not know where oil prices will be later this year (or next year). But we do know that demand for oil will decline as electric vehicles and other clean tech are exponentially adopted.

We do not know whether the US government will seek to lower the cost of healthcare for its poorest citizens. but we can have a high degree of confidence that the falling costs of genomic sequencing and compute power will dramatically improve cancer diagnostics, save lives and reduce the system-wide cost of cancer care in the US.

We don’t know when ultra processed foods will be appropriately taxed by governments but we do know that the costs it places on society are unsustainable and that this will inevitibly create headwinds for junk food manufacturers.

It can be difficult to take a long-term view. But history shows that when the cost of a better technology undercuts an existing technology, its adoption will grow exponentially…..

Since 2002, the growth in solar capacity worldwide has been exponential rather than linear – and has consistently exceeded the IEA’s forecasts

Source: IEA World Energy Outlooks 2002-2018, Simon Evans @ Carbon Brief and Auke Hoekstra

Whilst this by no means guarantees investment success, it is generally better to focus on areas with predictable long-term growth when looking for new investments. With this in mind, i’ve created a simple framework to guide my investing focus and efforts. I call it the ‘quandrant of predictions’.

This framework helps me avoid spending time in those tempting but unpredictable short term zones which absorb so much of the markets time. It also helps me remember that those difficult long-term predictions are an exercise in arrogance and futility. Patience and discipline is hard enough, better to forecast the easy stuff!

Capital at risk. This is not investment advice. The author may own shares in companies mentioned in the blog. Share prices can fall as well as rise and readers should seek financial advice before investing in any investment themes or stocks mentioned in this blog. In short, I try my best to be right, but I’m often wrong.